From 2007 to 2021, the market for ceramic sanitary ware in Latin America increased by a significant percentage year on year, registering compound annual growth. This growth was positive during the entire analysis period, but it varied throughout the years. In 2020, the growth rate was more compared to the previous year, while in 2021, it peaked. This growth is driven by a large number of factors, including the demand for ceramic sanitary ware in the region and the COVID 19 regulation.

Mexico is the largest Exporter of Ceramic Sanitary Wares

In terms of volume, Mexico is the largest exporter of ceramic sanitized wares in Latin America. In the last five years, the Mexican market has increased by a large percentage annually. Its consumption will increase by billions by 2022. But, the price will fluctuate considerably. In 2021, it was the largest exporter, while the next two largest exporters were Chile and Peru. Other countries in the region include Brazil, El Salvador, and Paraguay.

The Mexican market has a diverse range of products. Mexico exports sanitary ware to countries across the world. Its top five markets for ceramic sanitary wares by value are the USA, Germany, China, and Japan. The rest of Latin America is the third-largest market, accounting for most of the sales. The top five countries account for more than 50% of total global sanitary ware sales.

In terms of value, Mexico is the leading exporter of ceramic sanitary ware in Latin America. China is the largest exporter in Latin America, and its sanitary ware exports have increased by a significant percentage annually over the last few years. In addition to Mexico, Honduras, and Bolivia were also among the top five importing countries. However, the country's share of total Latin American exports has declined in recent years.

China is the one of the Largest Exporter of Ceramic Sanitary Ware

China is the leading exporter of ceramic sanitation ware in Latin America, accounting for a large share of the region's total output. Thailand and Mexico follow closely behind, respectively. Mexico is the second-largest exporter of this product, supplying approx five percent of the region's total supply. China, however, has been a leading supplier for over two decades, with a hefty export volume. The country is also one of the largest importers of ceramic sanitary ware. In 2021, China accounted for more than one-fifth of all ceramic sanitary ware imports in Latin America. Mexico ranked third in terms of total production. Other countries in the region were Italy and Malaysia.

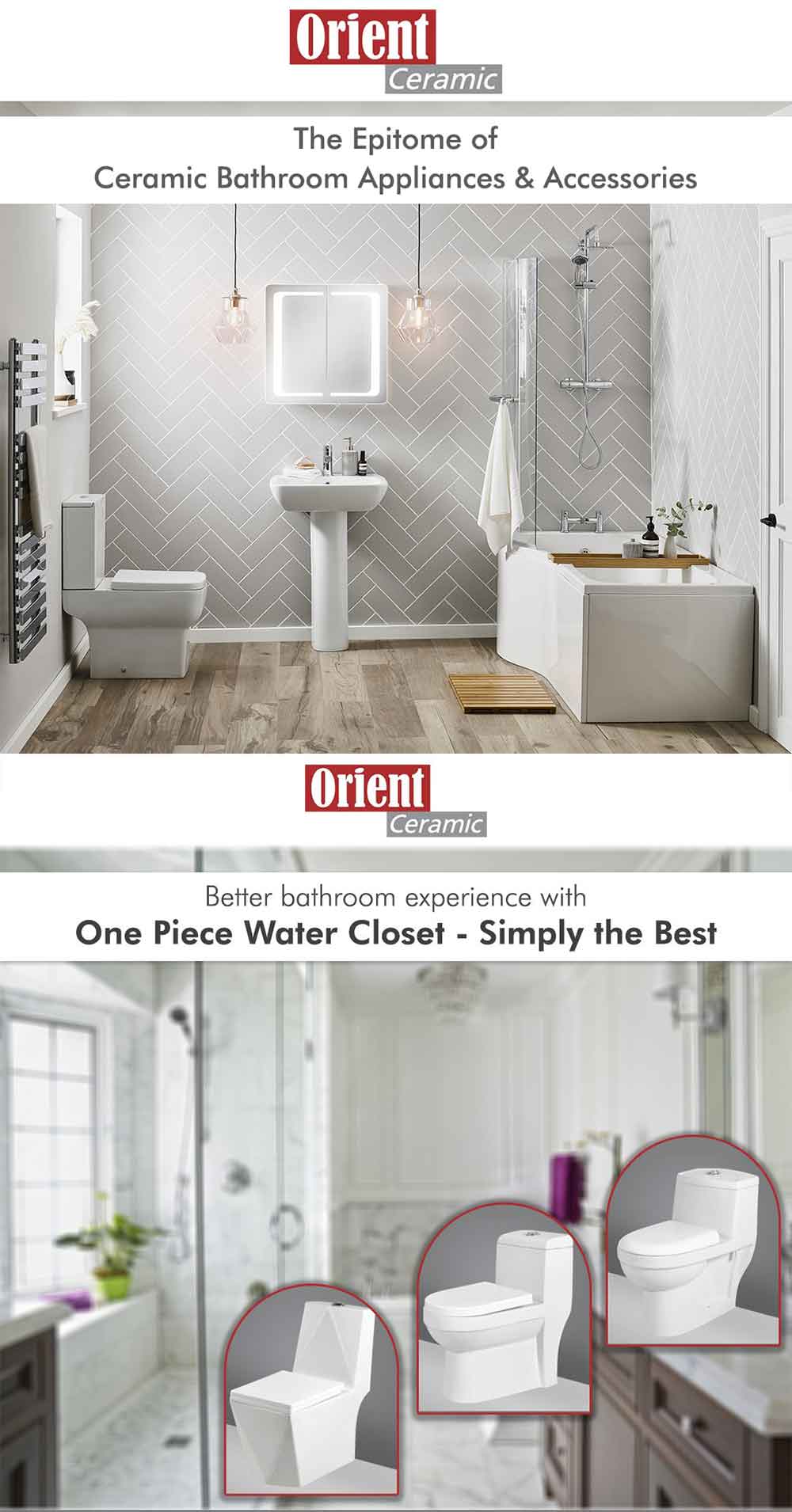

The market for ceramic sanitary ware is highly fragmented in the Asia-Pacific region. Many global players are present in this region but are focusing on expanding manufacturing units there. With the growing demand for sanitary ware, the region is expected to grow at a 6.8% CAGR in the next five years. Major players in the ceramic sanitary ware industry include Orient Ceramics.

COVID 19 has Affected the growth of the Ceramic Sanitary Ware Industry

The COVID-19 pandemic has significantly disrupted the global economy, affecting three major sectors: production, demand, and the, supply chain. This has resulted in a significant impact on the local economy, and the global trade and finance sectors. The current state of COVID-19 has prevented most manufacturers from completing ongoing projects in the construction sector, severely hampering the industry's growth.

The increase in the demand for the products is attributed to the fact that they are increasingly used in residential buildings. As such, countries with high growth in the real estate market are likely to fuel the growth of the ceramic sanitary ware industry. Although the market is a big one, COVID 19 is a challenge to the industry. It has, however, posed several opportunities for manufacturers, including a stronger currency exchange rate.

In Conclusion

Every region's ceramic sanitary ware market is highly fragmented, but a few key players dominate the market. Orient Ceramics is one of the most important players in the market, with large geographic footprints, and in the future will have more manufacturing capabilities and expand its global presence.

Make an Appoinment

Send us Message

Visit us at Address

Vagadiya Road, Thangadh - 363530,

Gujarat, India.

Gujarat, India.

© Copyright 2024, Orient Ceramics, All Rights Reserved.

Web Design & Development by Opal Infotech